You’re tracking website traffic, leads, and social engagement. The graphs are all pointing up. But then, a competitor you barely noticed poaches a major client. What happened?

You were looking at your own dashboard, not the entire playing field.

This is the real problem most marketers face. They measure performance in a vacuum, celebrating internal wins while competitors quietly eat their lunch. You don’t have a visibility problem; you have a relativity problem.

Monitoring Share of Voice (SOV) fixes this. It’s not just another metric; it's a competitive radar that measures your brand's visibility against everyone else in the market. A high SOV is a leading indicator of market share growth.

This guide provides a no-fluff framework to measure, monitor, and act on your share of voice.

Why SOV Is Your Most Important Competitive Metric

Share of Voice forces a critical shift in perspective. Instead of asking, "How are we doing?" you start asking, "How are we doing compared to our competitors?" This simple change transforms your marketing from a series of disconnected tactics into a cohesive competitive strategy.

When you track SOV, you get a clear view of the market dynamics.

- Spot threats early. You can identify emerging competitors capturing the conversation long before they show up in your sales reports.

- Validate your strategy. SOV tells you if your marketing campaigns are actually making a dent in the industry or just adding to the noise.

- Justify your budget. You can build a rock-solid business case for marketing investment by directly linking a higher SOV to future market share gains.

Mini Case Study: The SaaS Wake-Up Call

Imagine two SaaS startups, Innovate Inc. and Synergy Corp.

Innovate Inc. obsesses over its internal metrics—website visitors, lead conversions. Their numbers look great, and the team feels successful.

Synergy Corp. monitors its share of voice from day one. They quickly see that while their own traffic is growing, a single competitor is gobbling up 60% of all relevant keyword impressions and social mentions.

Armed with this data, Synergy Corp. launches a targeted content campaign to close the gap. Six months later, Innovate Inc. is blindsided when that same competitor steals one of their major clients. Synergy Corp. wasn't surprised—they saw it coming and had already adjusted their game plan.

To effectively track competitors, you need the right tools. For a solid rundown, check out these best competitor analysis tools.

What Share of Voice Actually Reveals

Let's cut the jargon. Share of Voice (SOV) is the percentage of the conversation in your market that is about your brand.

A bigger SOV means more people are talking about and seeing you than the competition.

The basic calculation is straightforward.

Share of Voice (SOV) = (Your Brand Mentions ÷ Total Industry Mentions) x 100

This formula applies across channels, from organic search to media mentions. The key is to stop looking at your metrics in isolation and start benchmarking against the entire competitive landscape.

SOV Predicts Market Share—Here's the Proof

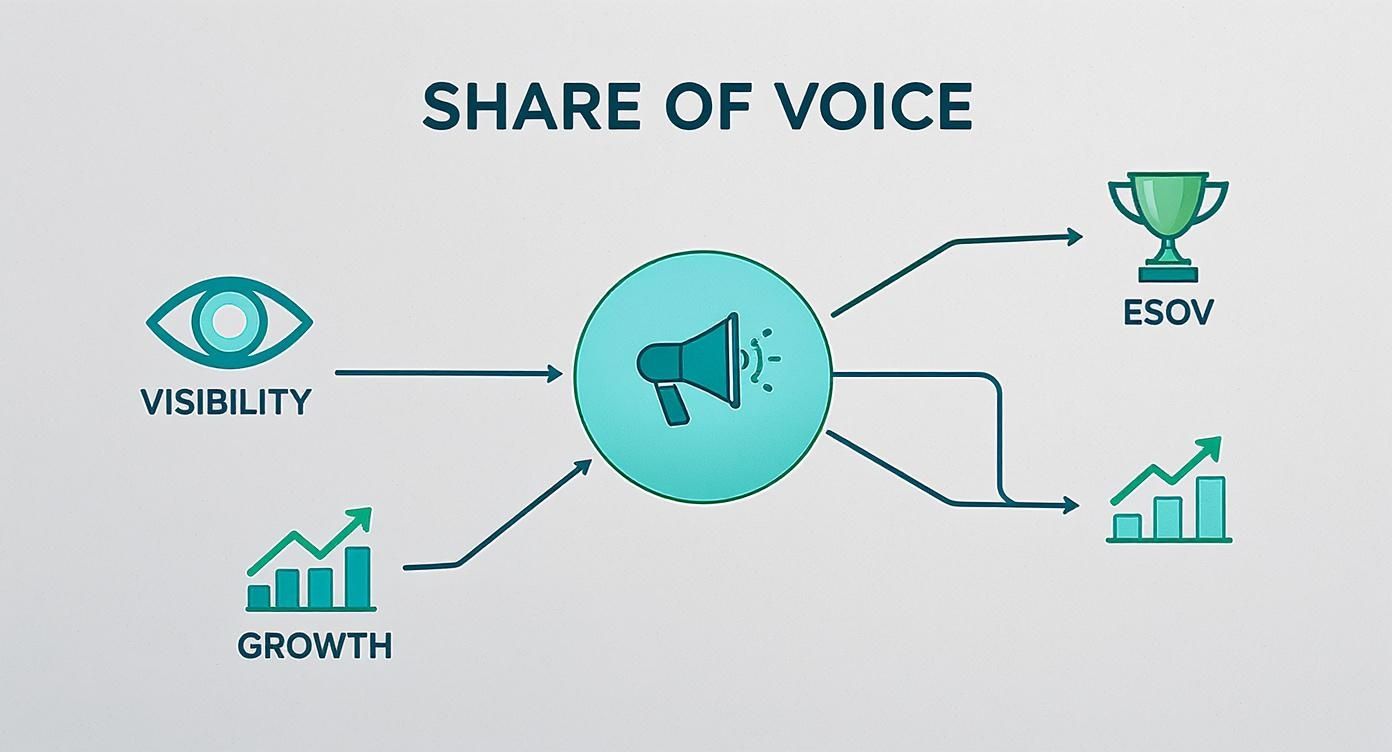

SOV and market share are not the same. SOV measures conversation and visibility; market share measures sales and revenue. But they are deeply connected. SOV is a leading indicator of future market share.

The link between them is a metric called Excess Share of Voice (ESOV).

ESOV is the difference between your Share of Voice and your current market share. A positive ESOV means you're punching above your weight—your brand is getting more attention than your market position suggests. This is one of the best predictors of growth.

For example, if you have a 5% market share but command a 10% share of voice, your ESOV is +5%.

Research from decades of campaign analysis found a powerful correlation: for every 10 points of ESOV a brand has, its market share tends to grow by about 0.5% per year. You can dig into the data in this analysis of share of voice and market growth.

Suddenly, that marketing budget is a lot easier to justify.

Mini Case Study: The Complacent Market Leader

A B2B software company we'll call 'ConnectSphere' was a leader in its niche. All their internal dashboards were green. They felt secure.

Then they ran their first SOV analysis. The result was a shock.

While they were celebrating their dominant market position, their actual Share of Voice was a mere 8%. Worse, a nimble new competitor—one they’d casually dismissed—was already gobbling up 15% of the industry conversation.

That single data point changed everything. It exposed a massive vulnerability. Their market leadership was built on past wins, but the future was being defined by a competitor. The data showed their dominant position was at risk, prompting an immediate strategy shift to reclaim the conversation.

How to Choose Where to Monitor Your SOV

Share of Voice isn't a single universal number. It’s a portfolio of measurements across the digital battlegrounds where you compete for attention.

Trying to monitor everything is a recipe for data overload. The key is to focus your energy where it counts. Prioritizing channels is a strategic trade-off, not a weakness. You must determine where your audience is and where competitors are making noise.

The Four Main Arenas for SOV

Your competitive landscape is split across several channels. Each requires its own lens, metrics, and tools.

- Organic Search (SEO): Measures how often your brand appears in search results for key terms versus your rivals. High visibility here is like owning the best shelf space in a store.

- Social Media: Tracks your brand’s slice of the conversation on platforms like X (formerly Twitter), LinkedIn, and Instagram. It’s not just mention volume, but the sentiment behind it.

- Paid Media (PPC): SOV here is impression share—the percentage of times your ads appeared out of the total times they could have. It’s a direct measure of your paid visibility.

- Media and PR: Tracks mentions in online news, blogs, and industry publications. This measures your earned media footprint.

This infographic shows how visibility and growth stem from the core concept of SOV.

The takeaway is that SOV is far from a vanity metric. It's a direct driver of visibility that fuels both growth and long-term market leadership.

The Right Metrics and Tools for Each Channel

To make this actionable, you need to know what to measure and which tools to use.

Share of Voice Monitoring Channels Compared

| Channel | What to Measure | Example Tools |

|---|---|---|

| SEO | Keyword Visibility: Percentage of clicks or impressions for a tracked set of keywords. | Ahrefs, Semrush |

| Social | Brand Mentions & Hashtags: Volume of direct mentions and hashtag usage. | Brandwatch, CisionOne |

| PPC | Impression Share: Your ad impressions divided by the total estimated impressions. | Google Ads, Microsoft Ads |

| Media/PR | Media Mentions: The number of times your brand is cited in online publications. | Google Alerts, Muck Rack |

For example, on social media, SOV is a raw reflection of how much public conversation a brand owns. If your brand gets 2,500 mentions in a month and the total for all competitors is 10,000, your social SOV is 25%. Tools like Brandwatch can pull this data and analyze sentiment, giving you a much richer view of brand perception.

A focused approach to monitoring share of voice beats a broad, shallow one every time. If you're looking to get laser-focused on search, you can learn more about how to boost your AI search visibility.

A 5-Step Framework for Monitoring Share of Voice

Forget complex dashboards. The goal is a simple, sustainable system that gives you a clear picture of where you stand.

Follow these five steps to go from abstract numbers to strategic insights.

Step 1: Define Your True Competitors

You need to know who you’re really competing against. Most brands get this wrong by only tracking direct rivals.

True competitor analysis goes deeper.

- Direct Competitors: Brands offering a similar solution (e.g., another project management software).

- Indirect Competitors: Brands solving the same problem with a different solution (e.g., a spreadsheet template company).

- Emerging Threats: New players gaining traction and sucking up conversation, even with tiny market share.

Ignoring the last two categories creates blind spots. List 3-5 competitors across these types.

Step 2: Pick Your Priority Channels

You cannot be everywhere. Trying to monitor every channel leads to useless data.

Ask yourself two questions:

- Where do our ideal customers research solutions or discuss their problems?

- Which channels are our competitors investing in most heavily?

For a B2B SaaS company, this might be LinkedIn and organic search. For a D2C brand, it might be TikTok and Instagram. Be ruthless. It's better to own the conversation on one key channel than have a weak presence across ten.

Step 3: Set Up Your Monitoring Tools

Now, turn your strategy into a system. Whether you use a platform like Ahrefs, a social listening tool like Brandwatch, or a specialized solution, setup is key.

Create a dedicated project for SOV tracking and feed it the right inputs.

- For SEO: Add your competitors and a core list of high-value keywords. The tool will track your search visibility against theirs.

- For Social: Set up listeners for your brand name, competitor brand names, and key industry hashtags.

- For AI Search: Input specific prompts your customers ask AI models, like "best X for Y," to see how you rank in generated answers.

Proper configuration ensures your data is clean and relevant.

Step 4: Establish Your Baseline

You cannot know if you are winning if you don’t know the score. Your first measurement is your baseline SOV.

This initial snapshot is the reference point for all future progress.

A common mistake is skipping this step. Without a baseline, you end up celebrating random spikes without knowing if you're gaining meaningful ground.

Document your initial SOV percentage for each priority channel. That number is your north star.

Step 5: Create a Simple Reporting Rhythm

Get a consistent schedule on the calendar for reviewing SOV data. A simple monthly or quarterly check-in is usually enough.

Your report should answer three simple questions:

- Did our SOV go up or down?

- Which competitor gained or lost the most ground?

- What likely caused any significant changes?

This rhythm turns monitoring from a one-time task into an ongoing strategic process.

How to Turn SOV Data into Smarter Decisions

Collecting data is easy. The hard part is figuring out what the numbers mean for your business. Raw SOV percentages are just noise until you translate them into action.

Monitoring SOV is about answering, "So what?"

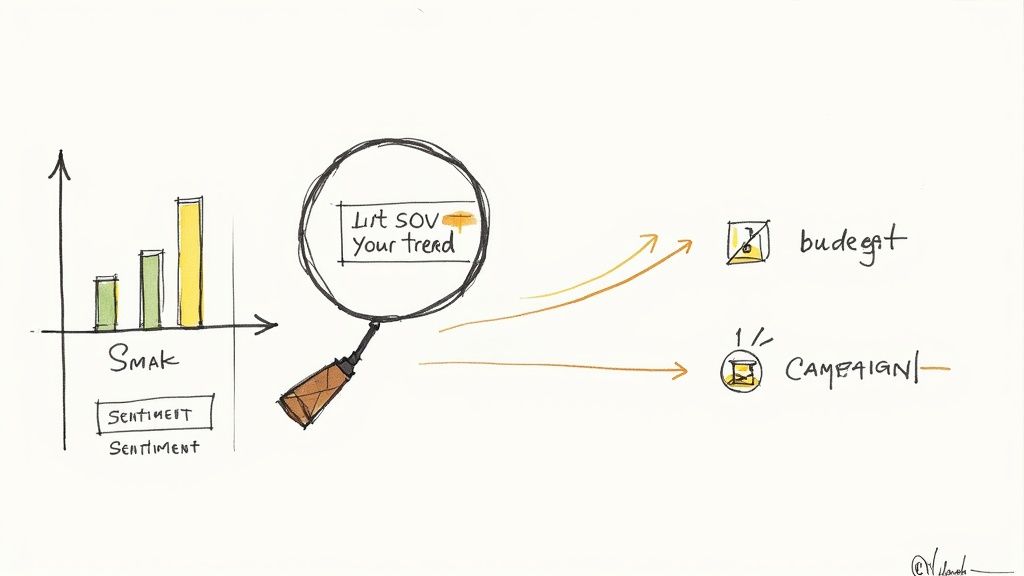

Look Beyond the Surface Number

A single SOV metric is a snapshot, not the whole story. To find real insight, you need to add context.

- Analyze Trends Over Time: Is your SOV trending up or down? A slow decline might reveal a competitor's sustained content push. A sudden spike could be tied to a PR win you can replicate.

- Segment by Topic or Product: Don't just track your brand name. Break down SOV by product lines or conversation topics. You might discover you dominate the conversation around a high-value niche, revealing a hidden strength.

- Layer in Sentiment Analysis: This is crucial. A high SOV with negative sentiment is a crisis, not a victory. A smaller SOV with positive sentiment shows a loyal core audience to build from.

Is 10% Share of Voice Good or Bad?

The answer: it depends entirely on your market. There is no universal "good" SOV.

A 10% SOV in a fragmented market with dozens of players could make you a dominant leader. That same 10% SOV in a market controlled by two giants means you're barely making a whisper.

The most important context is your market share, which brings us back to Excess Share of Voice (ESOV). If your SOV is higher than your market share, you are primed for growth.

From Insight to Action

Once you’ve analyzed the data, it's time to decide what to do. Your findings should directly inform your marketing strategy.

A common failure is treating SOV reports as historical documents. Treat them as a strategic compass guiding your next move.

Consider a fintech startup that noticed its SOV for "small business invoicing" was dropping by 2% each month. Digging deeper, they saw a competitor was publishing detailed guides on the topic, effectively owning the conversation.

This insight led to a clear action plan. They dedicated their content team to creating a comprehensive resource hub on invoicing. Within a quarter, they not only stopped the decline but also increased their SOV for that specific topic by 5%.

Ultimately, monitoring share of voice enables robust data-driven decision making, allowing you to refine your strategies with confidence.

Your First Three Steps to Mastering SOV

Real progress happens when you take action. The point isn't to build perfect reports—it's to gain a strategic edge.

Starting small and staying consistent is more effective than chasing a perfect setup that never gets finished.

Step 1: List Your Top Competitors

Define the battlefield. Go beyond the obvious names.

List your top three rivals across two categories:

- Direct: Companies with a nearly identical solution.

- Indirect: Companies solving the same customer problem with a different approach.

This simple exercise immediately widens your perspective.

Step 2: Pinpoint Your Most Important Channel

You can't dominate every channel at once. Prioritize ruthlessly. Where do your customers actually spend their time?

Is it Google Search? LinkedIn? A niche industry forum?

Pick one primary channel to focus on first. This prevents data overload and makes your initial efforts manageable.

Step 3: Establish Your Baseline Today

You need a starting point. Without a baseline, you cannot measure progress.

The most common mistake is delaying action while searching for the perfect tool. The best time to get your first SOV reading is right now.

Use a free trial of a monitoring tool and run your first analysis. This initial measurement gives you a concrete number to work from. It instantly transforms SOV from an abstract concept into a real metric.

These three steps are all you need to start. For a refresher on the math, our guide breaks down how to calculate share of voice in detail.

Frequently Asked Questions About SOV

Here are answers to common questions about tracking share of voice.

How Often Should I Check My Share of Voice?

For most brands, a monthly check-in is the sweet spot. It’s frequent enough to catch important shifts without getting bogged down in daily noise.

If you're in a major product launch or a competitive campaign, switching to a weekly review is a smart move. It provides the feedback needed to pivot quickly. The goal is consistency, not constant obsession.

Can I Monitor SOV on a Tight Budget?

Yes. You don't need an expensive all-in-one suite. Focus on one key channel with free or low-cost tools.

- For SEO: Use the free versions of tools like Semrush or Ahrefs to track rank for a small set of core keywords.

- For Media Mentions: Set up Google Alerts for your brand and your top three competitors. It’s free and surprisingly effective.

Starting small is better than doing nothing.

How Do I Identify All My Competitors?

Your direct competitors are easy. The biggest threats are often the ones you aren't looking for.

Ask yourself: "If our solution disappeared tomorrow, what would our customers use instead?"

The answer reveals your true competitive landscape. A project management tool competes with other PM software, but also with spreadsheets and sticky notes. Monitoring these indirect rivals provides a more honest picture of your market.

Ready to stop guessing where you stand? AI SEO Tracker shows you exactly how visible your brand is in ChatGPT, Gemini, and other AI engines. See how you stack up against the competition and get a clear plan to win the high-intent questions that matter.