Your competitors are launching features, changing prices, and targeting your customers. Relying on guesswork is like navigating a maze blindfolded. You're constantly reacting, not leading.

The real problem isn't a lack of data; it's the absence of a systematic approach to turn that data into a decisive advantage. This guide provides ten specific, actionable competitive intelligence strategies for modern teams. We'll show you not just what to do, but precisely how to do it.

This isn't about spying; it's about being smarter, faster, and more prepared.

You will learn how to uncover a rival’s product roadmap, understand why you’re really losing deals, and even see what prompts your shared customers are asking AI assistants—a battlefield most companies are completely ignoring.

For a comprehensive overview of core concepts, see this guide on What Is Competitive Intelligence and How to Use It. We'll build on those fundamentals with advanced tactics.

1. SWOT Analysis: Find Your Strongest Attack Vector

SWOT (Strengths, Weaknesses, Opportunities, Threats) is a foundational framework. It provides a structured grid to evaluate your company’s internal factors (Strengths, Weaknesses) against external market dynamics (Opportunities, Threats).

It’s the simplest way to connect your internal capabilities to the broader competitive landscape.

This method is the perfect starting point for developing a strategic plan, launching a new product, or pivoting your marketing message.

How to Implement a SWOT Analysis

- Assemble a Cross-Functional Team: Gather insights from marketing, sales, product, and customer support. A marketer might see a feature as a strength, while support knows it’s a source of frequent customer complaints (a weakness).

- Brainstorm Each Quadrant:

- Strengths: What do you do better than anyone else? (e.g., proprietary algorithm, 95% customer retention, strong brand).

- Weaknesses: Where do competitors outperform you? (e.g., higher price point, missing key integrations, clunky UI).

- Opportunities: What external factors can you capitalize on? (e.g., a competitor’s recent pricing increase, a new industry trend like AI integration).

- Threats: What external factors could harm your business? (e.g., new market entrants, changing data privacy regulations).

- Prioritize and Connect Insights: Don't just list points. Draw connections. How can you use a strength to seize an opportunity? How can you mitigate a weakness that makes you vulnerable to a threat? This is where strategy forms.

Pro Tip: Don't stop at your own SWOT. Create a hypothetical SWOT for your top 2-3 competitors. This reveals their likely view of the market and their strategic blind spots.

Mini Case Study: TaskFlow vs. ProjectKing

A project management SaaS, "TaskFlow," conducted a SWOT. They identified a strength in their intuitive UI and a threat from a major competitor, "ProjectKing," who just acquired a data analytics company. The resulting action was to launch a campaign highlighting TaskFlow's simplicity as a direct counter-position to ProjectKing's now more complex, enterprise-focused offering. This turned a potential threat into a messaging opportunity.

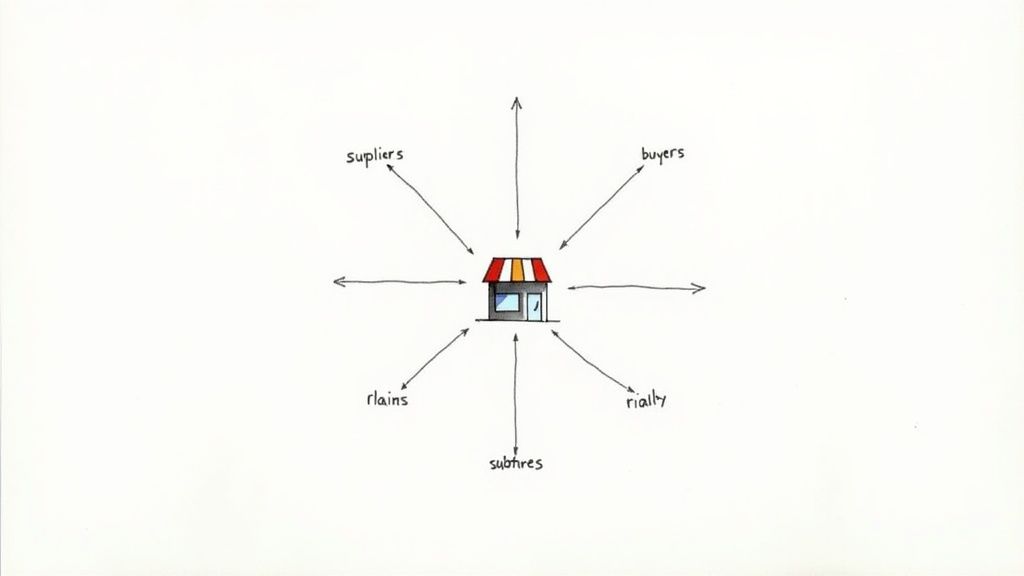

2. Porter's Five Forces: Map the Industry Power Dynamics

Developed by Michael Porter, this framework evaluates an industry's structure and competitive intensity. Unlike SWOT, it focuses exclusively on external forces that shape profitability.

It helps you understand the underlying dynamics of your industry to find a position where you can best defend against competitive forces. This method is ideal for evaluating the long-term attractiveness of a market.

How to Implement Porter's Five Forces Analysis

- Gather Industry-Wide Data: Collect info on market size, growth rates, key players, and pricing trends. This is about the entire ecosystem, not just your rivals.

- Analyze Each of the Five Forces:

- Competitive Rivalry: How many competitors do you have? (e.g., The CRM market has intense rivalry with Salesforce, HubSpot, and Zoho).

- Threat of New Entrants: How easy is it for new companies to enter your market? Are there high barriers like proprietary technology?

- Threat of Substitute Products: How easily can customers find a different way to solve their problem? (e.g., A substitute for project management SaaS could be a simple spreadsheet).

- Bargaining Power of Buyers: How much power do your customers have to drive down prices? This is high when switching costs are low.

- Bargaining Power of Suppliers: How much power do your suppliers (e.g., AWS, data providers) have to increase prices?

- Synthesize and Strategize: Evaluate the overall intensity. An industry where all five forces are strong is structurally unattractive. Identify the most powerful forces and develop strategies to mitigate them.

Pro Tip: Revisit your Five Forces model annually or after a significant market event, like a major merger. The forces constantly shift.

3. Competitive Benchmarking: Replace Guesswork with Hard Targets

Competitive benchmarking is a systematic process of measuring your company's performance against your top competitors. It provides quantitative data on where you stand, identifying specific performance gaps.

This is one of the most powerful competitive intelligence strategies because it sets clear goals. Instead of just feeling like your customer acquisition cost is high, benchmarking shows you how high it is compared to your most efficient rival.

How to Implement Competitive Benchmarking

- Identify Key Metrics: Determine what to measure. For a SaaS business, this could be Monthly Recurring Revenue (MRR) growth, customer churn, or Lifetime Value (LTV).

- Select Competitors and Best-in-Class Companies: Choose a mix of direct competitors and "best-in-class" companies. A B2B SaaS might benchmark its onboarding against Duolingo for engagement, not just a rival.

- Gather Data: Use public financial reports, industry studies, and specialized competitor analysis tools for SEO to reveal traffic sources and content performance.

- Analyze Gaps and Formulate Action Plans: Compare the data to identify performance gaps. If a competitor's organic traffic is 3x yours with a similar domain authority, analyze their content strategy. Create specific, measurable initiatives.

Pro Tip: Focus on benchmarking processes, not just outcomes. A competitor might have a lower churn rate (outcome). The valuable insight is discovering why—perhaps they have a superior customer success process (process) you can adapt.

Mini Case Study: MailSphere Boosts Adoption

An email marketing SaaS, "MailSphere," noticed its feature adoption rate was lagging. They benchmarked their user onboarding against a direct competitor and the project management tool "Asana." They discovered Asana used interactive, in-app checklists. MailSphere implemented a similar checklist. This led to a 25% increase in key feature adoption within the first month.

4. Customer and Market Research: Find What Competitors Overlook

This strategy involves collecting data about your target audience and the broader market. It moves beyond assumptions, providing direct insight into customer pain points and buying behaviors.

This is the most direct way to validate product-market fit and ensure marketing messages resonate. It grounds your decisions in evidence, not internal guesswork.

How to Implement Customer and Market Research

- Define Your Research Objectives: Start with a clear question. Are you trying to understand churn, identify features for your next update, or find a unique messaging angle?

- Employ Mixed Methods for a Complete Picture:

- Qualitative: Conduct one-on-one interviews or usability tests to understand the "why." To gain deeper insights into customer behavior, exploring customer journey mapping can reveal critical touchpoints.

- Quantitative: Use surveys and analytics data to gather statistically significant data on "what" is happening at scale.

- Competitive Listening: Analyze customer reviews and forum discussions about your competitors. What are their customers complaining about? That’s your opportunity.

- Synthesize and Share Findings: Create actionable insights. Develop detailed customer personas, identify key messaging themes, and present the findings to product, sales, and leadership.

Pro Tip: Set up continuous feedback loops. Use tools like in-app surveys (e.g., Hotjar) and regular customer interviews to keep a constant pulse on market sentiment.

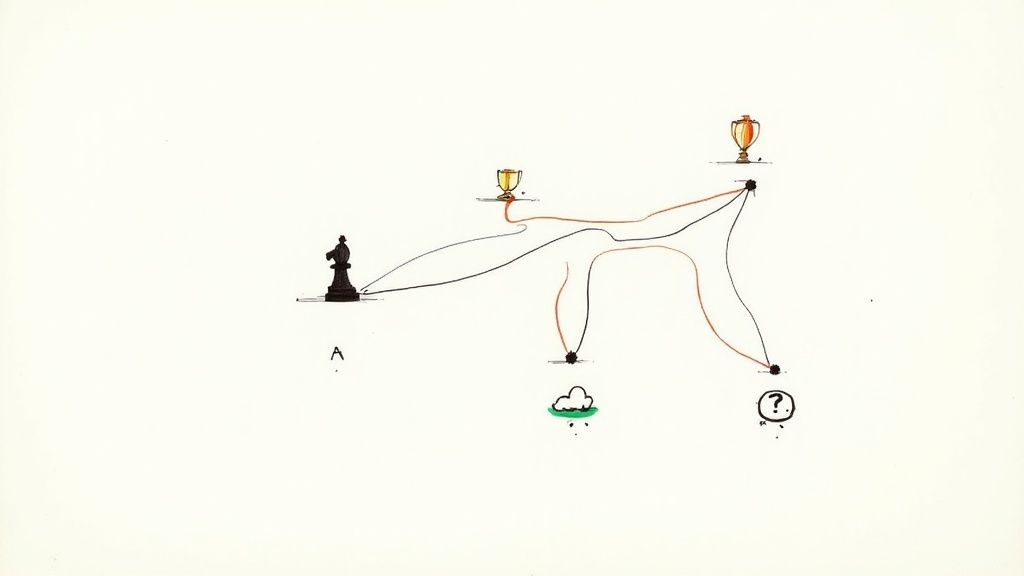

5. Scenario Planning and War Gaming: Prepare for an Uncertain Future

Scenario planning and war gaming are forward-looking strategies that prepare your organization for multiple plausible futures. Instead of predicting a single outcome, you simulate how your company and competitors would react in different scenarios.

This proactive approach pressure-tests strategies against potential market shifts or aggressive competitor moves before they happen. It helps identify blind spots and build resilience.

How to Implement Scenario Planning and War Gaming

- Identify Key Uncertainties: Determine the 2-3 most critical and uncertain external forces, like new AI regulations or a major competitor merger.

- Develop Plausible Scenarios: Create 3-4 distinct future narratives. For example: "The Regulated AI World," "The Open-Source Dominance," or "The Enterprise Consolidation."

- Conduct a War Game: Assemble cross-functional teams representing your company and key competitors. Role-play through a scenario over a series of "moves." Your team proposes an action, and the "competitor" team reacts.

- Extract Strategic Insights: After the simulation, debrief to identify key takeaways. What strategies worked best? What early warning signs ("signposts") should you monitor to know which scenario is unfolding?

Pro Tip: Use an LLM like ChatGPT to accelerate scenario creation. Prompt it with: "We are a B2B SaaS in [your industry]. Our key uncertainties are [uncertainty 1] and [uncertainty 2]. Generate four detailed, plausible future scenarios for our market in 2028."

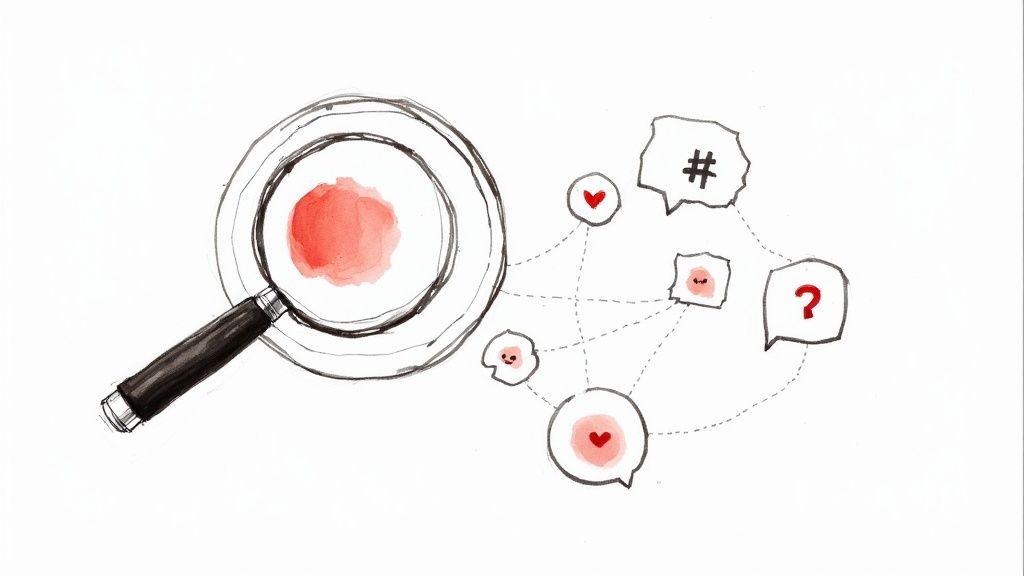

6. Social Media and Digital Listening: Tap the Unfiltered Voice of the Customer

This strategy involves monitoring real-time conversations across platforms like Twitter, Reddit, and review sites. It provides raw, immediate feedback on your brand, your competitors, and emerging trends.

It allows you to intercept customer service issues, identify content opportunities, and gauge the market’s reaction to a competitor’s launch in real-time.

How to Implement Social Media and Digital Listening

- Define Your Listening Goals: Are you tracking brand sentiment, looking for feature requests, or monitoring a competitor’s campaign? Clarity is key.

- Set Up Your Listening Streams: Use tools like Brandwatch or Sprout Social to create dedicated feeds.

- Brand Keywords: Monitor mentions of your company and products.

- Competitor Keywords: Track your top rivals and common complaints about them.

- Industry Keywords: Follow conversations around relevant pain points and software categories (e.g., "CRM for startups").

- Analyze and Categorize Insights: Use a combination of AI-powered sentiment analysis and manual review. Tag conversations by theme (e.g., "bug report," "pricing complaint," "feature idea"). This turns chaotic mentions into structured data.

Pro Tip: Look for "switching" language. Set up alerts for phrases like "alternative to [Competitor X]?" or "frustrated with [Competitor X]". These are high-intent signals from potential customers.

7. Patent and Technology Intelligence: See Your Competitor's Future Roadmap

This forward-looking strategy focuses on what your competitors are building, not just what they’ve launched. It involves analyzing patent filings and research papers to map out a rival’s R&D roadmap.

This method reveals where a competitor is investing its most valuable resources: innovation. It allows you to anticipate market shifts driven by new technology.

How to Implement Patent and Technology Intelligence

- Identify Key Competitors and Technologies: List your top rivals and the core technologies central to your industry (e.g., AI/ML algorithms, data encryption).

- Monitor Patent Databases: Use official databases like USPTO or specialized platforms like PatSnap. Set up alerts for filings by target competitors.

- Assignees: Track the companies filing patents.

- Inventors: Note key engineers; their movement between companies can signal strategic shifts.

- Claims: Analyze the claims to understand the specific capabilities the technology protects.

- Analyze and Synthesize Findings: Don't just collect patents. Look for clusters and patterns. A sudden burst of patents around machine learning suggests a competitor is developing an AI-powered analytics tool.

Pro Tip: Look at the "prior art" cited in a competitor's patent. This tells you what existing technologies they believe their invention improves upon—a direct signal of their perceived value proposition.

8. Win/Loss Analysis: Get Unfiltered Feedback from Real Deals

Win/Loss analysis is a systematic process of interviewing new customers and lost prospects to understand exactly what drove their final decision. It provides invaluable, ground-level truth about product gaps, pricing friction, and sales effectiveness.

This method uncovers the “why” behind your CRM’s “closed-won” or “closed-lost” tags. It delivers qualitative insights that quantitative data often misses.

How to Implement a Win/Loss Analysis

- Define a Trigger and Timeline: The best feedback is fresh. Initiate interviews within 15-30 days of a deal’s conclusion. Automate this trigger through your CRM.

- Conduct Unbiased Interviews:

- Wins: Ask what sealed the deal. Was it a specific feature, the onboarding, or the salesperson?

- Losses: Ask tactfully why they chose a competitor. Was your pricing unclear? Was a key feature missing? Focus on product, price, and process.

- Synthesize and Share Findings: Create a centralized dashboard or quarterly report. Tag reasons for loss (e.g., #pricing, #feature-gap-analytics) to spot recurring patterns. Share these findings with product, marketing, and sales leadership.

Pro Tip: Use a neutral third party for loss interviews if possible. Prospects are often more candid with an independent researcher than with the salesperson they just turned down.

9. Executive and Industry Intelligence Networks: Access the "Why" Behind the "What"

This strategy involves building a network of industry executives, advisors, and consultants to gather qualitative insights and strategic context that raw data can't provide.

This is how you uncover the real reason behind a competitor's move. It’s invaluable for validating a strategic pivot or understanding the impact of a new technology before it becomes mainstream news.

How to Implement an Intelligence Network

- Identify and Map Key Individuals: Create a "power map" of influential people in your niche, including venture capitalists, respected consultants, and even executives who recently left competitor companies.

- Provide Value First: Strong networks are built on reciprocity. Share your own non-proprietary insights or make helpful introductions before you ask for anything.

- Establish a Systematic Cadence: Schedule regular, informal check-in calls with key contacts. The goal is to build an ongoing dialogue.

- Synthesize and Disseminate Ethically: Gather notes, identify recurring themes, and share a sanitized summary with your leadership. Always respect confidentiality and adhere to all legal and ethical guidelines.

Pro Tip: Create a small, formal advisory board of 2-4 industry veterans. Offering a modest stipend can secure invaluable, structured access to top-tier strategic minds.

10. Pricing and Product Intelligence: Monitor Your Competitor's Value Proposition

This strategy focuses on continuously monitoring competitor pricing, features, and product positioning. It provides a dynamic view of how rivals package and price their value.

It ensures your product and pricing strategies are not developed in a vacuum. This directly informs decisions on feature prioritization and go-to-market positioning. You can track search visibility for these product updates with an AI overview tracker to see how they impact rankings.

How to Implement Pricing and Product Intelligence

- Create a Feature Comparison Matrix: Build a detailed spreadsheet mapping your features against your top 3-5 competitors. Update it quarterly.

- Automate Price Monitoring: Use price tracking software to monitor changes in competitor subscription pages and promotional offers.

- Analyze Bundling and Positioning: Review how competitors bundle their services. Are they offering multi-product discounts? Is their core offering positioned as a low-cost leader or a premium solution?

- Connect Pricing to Value: Don't just track numbers; analyze the why. Is a price increase tied to a major feature release? This context is where insight is found.

Pro Tip: Monitor competitors' G2 or Capterra reviews for mentions of pricing and features. Customer feedback often highlights what parts of a competitor's product are overvalued.

10-Strategy Competitive Intelligence Comparison

| Method | Implementation Complexity (🔄) | Resource Requirements (⚡) | Expected Outcomes (📊) | Ideal Use Cases (💡) | Key Advantages (⭐) |

|---|---|---|---|---|---|

| SWOT Analysis | 🔄 Low — workshop-style synthesis | ⚡ Low — few participants, basic data | 📊 High-level strengths/risks and strategic priorities | 💡 Early-stage strategy, quarterly reviews, cross-functional planning | ⭐ Simple, flexible, combines internal & external views |

| Porter's Five Forces Analysis | 🔄 Medium — requires industry synthesis | ⚡ Medium–High — market data and analyst time | 📊 Structural view of industry attractiveness and profit levers | 💡 Market entry, sector investment, competitive positioning | ⭐ Deep industry-structure insight; highlights strategic levers |

| Competitive Benchmarking | 🔄 Medium — metric selection and comparison | ⚡ Medium — data collection, tooling, benchmarks | 📊 Quantified performance gaps and measurable targets | 💡 Operational improvement, process optimization, performance goals | ⭐ Actionable targets and best-practice identification |

| Customer and Market Research | 🔄 Medium–High — mixed-methods design & analysis | ⚡ High — surveys, panels, analytics, vendors | 📊 Validated customer needs, segmentation, demand signals | 💡 Product development, go-to-market strategy, CX design | ⭐ Direct customer insight; reduces product/market risk |

| Scenario Planning & War Gaming | 🔄 High — scenario development and facilitation | ⚡ High — cross-functional time, facilitation, tools | 📊 Prepared contingencies and tested strategic options | 💡 Long-term strategy, disruption readiness, executive rehearsals | ⭐ Builds adaptability and anticipates competitor moves |

| Social Media & Digital Listening | 🔄 Low–Medium — tool setup and monitoring rules | ⚡ Medium — listening platforms and analysts | 📊 Real-time sentiment, emerging issues, trend signals | 💡 Brand monitoring, crisis detection, rapid product feedback | ⭐ Fast, cost-effective, large-scale unfiltered insights |

| Patent & Technology Intelligence | 🔄 High — technical document analysis | ⚡ High — patent databases, specialist expertise | 📊 Early signals of R&D direction and technology gaps | 💡 R&D strategy, IP planning, partnership and licensing scouting | ⭐ Reveals competitor innovation legally and early |

| Win/Loss Analysis | 🔄 Medium — structured interviews and tracking | ⚡ Medium — CRM integration, interviews, analyst time | 📊 Specific reasons for deal outcomes and sales improvements | 💡 Sales enablement, pricing strategy, B2B deal optimization | ⭐ Direct revenue-impacting insights from customers |

| Executive & Industry Intelligence Networks | 🔄 Medium — relationship building and curation | ⚡ Medium–High — networking, conferences, time investment | 📊 Contextual, interpretive insights and non-public perspectives | 💡 Strategic partnerships, high-level market context, deal sourcing | ⭐ Context-rich, timely expert perspectives and access |

| Pricing & Product Intelligence | 🔄 Medium — continuous monitoring and analysis | ⚡ Medium — monitoring tools, scraping, data ops | 📊 Competitive pricing, feature visibility, launch tracking | 💡 Dynamic pricing, product positioning, e‑commerce strategy | ⭐ Direct impact on revenue and competitive positioning |

Turn Intelligence into Action, Not Another Report

You now have ten powerful competitive intelligence strategies. The most common mistake isn't a lack of information; it's a failure to act on it. An intelligence program that only produces dense reports is a resource drain, not a strategic asset.

The goal is to choose the one strategy that solves your most pressing problem right now.

This transforms competitive intelligence from a passive research activity into an active, offensive capability. For teams looking to enhance their offerings, learn more about AI optimization for making products more visible to stay ahead.

Your First Move: From Insight to Impact

Your next step is to diagnose your biggest blind spot and select a single, focused initiative for the coming quarter.

Here’s a simple framework to guide your decision:

- If you’re losing deals and don’t know why: Start with Win/Loss Analysis. This is the most direct path to understanding sales effectiveness and pricing objections.

- If you’re struggling with brand perception: Implement Social Media and Digital Listening. This gives you unfiltered access to what customers are saying in real-time.

- If you need to optimize product-market fit: Focus on Competitive Benchmarking. A deep dive into rival feature sets and pricing provides a clear roadmap.

Build a Sustainable Intelligence Culture

Implementing these strategies is about building a culture of curiosity and proactive decision-making. It’s about arming your teams with the insights they need to anticipate market shifts, neutralize competitor moves, and delight customers.

Don't let this article become just another bookmark. Pick your starting point, assign clear ownership, and define what success looks like. The most successful companies don't just have information; they have a bias for action.

Ready to see where your brand stands in the new AI-driven search landscape? AI SEO Tracker helps you discover the exact prompts your customers are using, track your rankings in AI answers, and close content gaps against competitors. Stop guessing and start winning in AI search by visiting AI SEO Tracker to see how it works.